HMM

One of the well known machine learning algorithms in the sequential data analysis is Hidden Markov Model (HMM). It has been one of the popular algorithms used in speech recognition, handwriting recognition, and time series analysis.

Hidden Markov Model (HMM) is a type of probabilistic model. It assumes that the data is generated by unobserved (hidden) states while we can only observe the probabilistic outputs from the states.

Imagine there are two urns, one with 10 red balls and 5 blue balls, and the other with 5 red balls and 10 blue balls. There's a person who picks one of the urns randomly and picks a ball from it.

A person picks a ball from one of the urns.

We only can observe the balls but not the urns. Problem that HMM (hidden markov model) solves is to infer the hidden states (urns) from the observed outputs (balls). This is useful in many applications such as speech recognition, handwriting recognition, and time series analysis. For example, in speech recognition, the hidden states are the words, and the observed outputs are the audio signals. From the audio, we infer the words.

During this process, HMM identifies multiple things:

- Probability of starting from a certain state

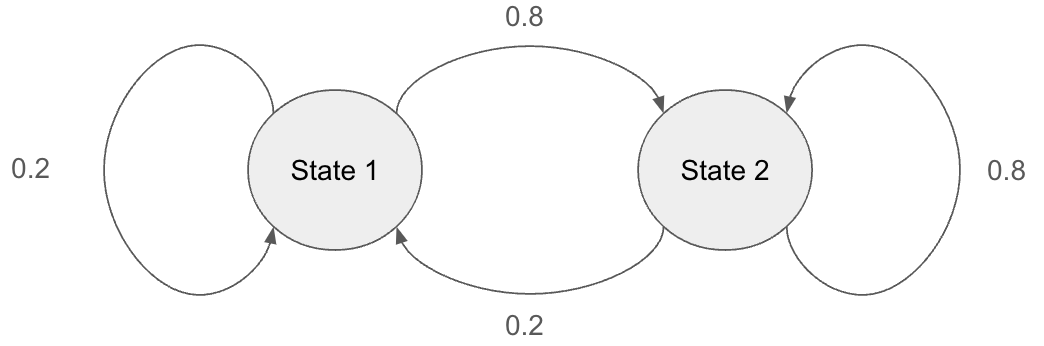

- Transition probability between states

- Emission probability of observing an output from a state

Two states $S_1$ and $S_2$ with transition probabilities annotated.

When applying HMM to the bitcoin price, we aim to infer the current state, which is hidden from us, from the price changes so far. After then, we infer the next state using the identified transition probability as well as the output from the emission probability.

Gaussian Mixture as the Output Distribution

In each state, HMM assumes that the output is generated from a specific distribution. For instance, if an urn contains 5 red balls and 10 blue balls, the probability of drawing a red ball is $5/15$ and the probability of drawing a blue ball is $10/15$. However, for continuous values like stock prices, we need a distribution that can more flexibly represent the data.

A Gaussian Mixture models a distribution as a combination of multiple Gaussian distributions (aka normal distributions or bell-shaped curves). It is powerful in representing complex distributions and can approximate any distribution given a sufficient number of components. Therefore, we use GMM to model the output distribution in each state.

A Gaussian Mixture Model with three Gaussian distributions

HMM for Air Passengers

To demonstrate model performance, we show the model's prediction results for the following day. The cross validation process identified the best transformation to make the timeseries stationary and the optimal hyperparameters. The Root Mean Squared Error on the next day's closing price was used to determine the best model.

The chart below illustrates: 1) the model's fit to the training data, and 2) its prediction for the training data periods. Note that model was trained to predict the right next day's closing price. Therefore, the prediction in the long term horizon is not expected to be accurate.

HMM is probabilistic model. It means that the model is not expected to regularity that's somewhat clear to human eyes.